7 Simple Techniques For Hard Money Georgia

Wiki Article

Hard Money Georgia Things To Know Before You Buy

Table of ContentsThe Ultimate Guide To Hard Money GeorgiaAll About Hard Money GeorgiaSome Known Details About Hard Money Georgia The Ultimate Guide To Hard Money GeorgiaHard Money Georgia - An OverviewThe Of Hard Money Georgia

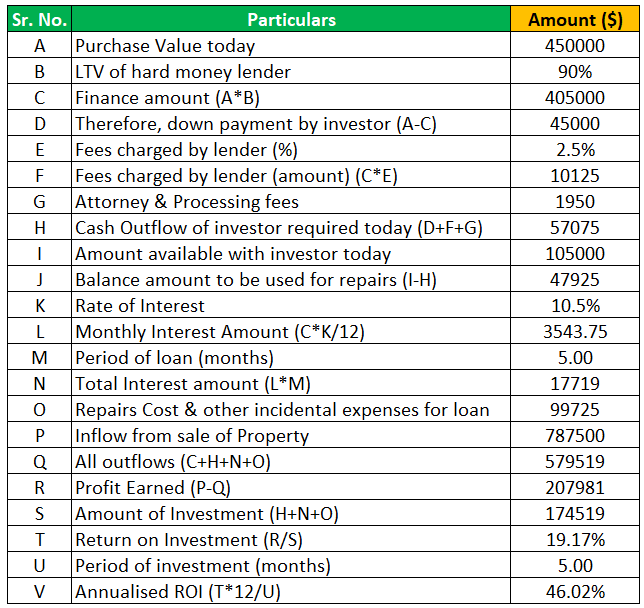

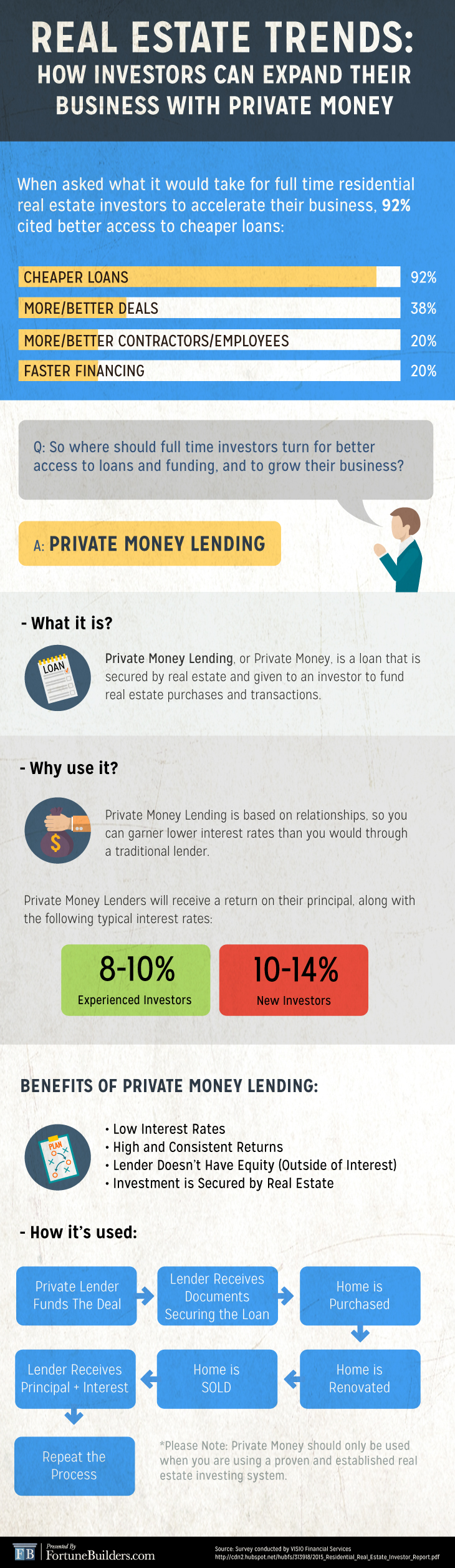

Considering that tough cash finances are collateral based, also called asset-based loans, they require minimal paperwork and also permit financiers to close in an issue of days - hard money georgia. These fundings come with more danger to the lending institution, and also therefore need greater down repayments and also have greater rate of interest rates than a conventional funding.Lots of standard fundings might take one to two months to close, yet tough money fundings can be shut in a few days.

Many tough cash financings have brief payment periods, normally between 1-3 years. Traditional home loans, on the other hand, have 15 or 30-year repayment terms generally. Hard cash loans have high-interest rates. A lot of tough cash car loan rate of interest are anywhere in between 9% to 15%, which is significantly more than the rate of interest you can anticipate for a standard mortgage.

Hard Money Georgia for Dummies

When the term sheet is authorized, the loan will certainly be sent out to processing. Throughout car loan processing, the lending institution will certainly ask for papers and also prepare the car loan for last funding testimonial as well as routine the closing.

How Hard Money Georgia can Save You Time, Stress, and Money.

Typical exit techniques include: Refinancing Sale of the asset Payment from various other source There are several situations where it may be helpful to make use of a hard money loan. For starters, investor that such as to house flip that is, buy a review home in demand of a great deal of work, do the job directly or with service providers to make it better, then turn around and market it for a greater price than they purchased for may locate hard money financings to be optimal financing alternatives.

Due to this, specialist house fins generally like temporary, fast-paced financing services. On top of that, home flippers usually try to sell houses within less than a year of buying them. As a result of this, they do not need a long-term as well as can stay clear of paying as well much passion. If you buy financial investment buildings, such as rental residential or commercial properties, you may likewise discover hard money financings to be good choices.

In some instances, you can likewise use a tough cash lending to buy vacant land. Keep in mind that, also in the above scenarios, the potential negative aspects of difficult cash fundings still use.

Excitement About Hard Money Georgia

While these kinds of loans may appear tough as well as challenging, they are a frequently made use of financing approach several real estate financiers use. What are hard money lendings, and also just click here to read how do they function?Tough cash loans generally include higher passion rates and also much shorter payment routines. Why choose a hard money finance over a standard one? To respond to that, we should initially consider the benefits and downsides of hard money financings. Like every monetary device, difficult cash important site loans come with advantages and also downsides.

A tough money car loan might be a viable alternative if you are interested in a fixer-upper that might not certify for standard funding. You can likewise use your existing realty holdings as security on a difficult cash loan. Tough cash loan providers generally minimize danger by billing higher rate of interest prices and also providing shorter repayment schedules.

The Only Guide for Hard Money Georgia

Additionally, since exclusive individuals or non-institutional lending institutions supply difficult money financings, they are exempt to the very same guidelines as standard lending institutions, which make them more dangerous for customers. Whether a tough cash financing is appropriate for you relies on your scenario. Tough cash car loans are great choices if you were rejected a standard financing and require non-traditional browse this site financing., we're right here to assist. Obtain began today!

The application process will commonly include an assessment of the residential or commercial property's worth and potential. That method, if you can not manage your settlements, the difficult cash lender will simply continue with offering the property to recover its financial investment. Hard cash lending institutions typically charge higher interest prices than you 'd have on a standard financing, however they also money their loans faster and also normally call for much less documentation.

4 Easy Facts About Hard Money Georgia Described

Rather of having 15 to thirty years to repay the finance, you'll normally have simply one to five years. Tough money financings function quite in a different way than typical finances so it is very important to comprehend their terms and what purchases they can be used for. Tough money fundings are typically meant for financial investment residential properties.Report this wiki page